One Audit

We prioritize auditing for assurance, compliance, and risk management in your business. With our four auditing pillars – External, Internal, Tax, and Forensic Audits – we ensure accuracy and integrity in financial and operational processes. Our experienced auditors provide valuable insights for your business’s financial health and regulatory compliance, guiding you towards sustainable success.

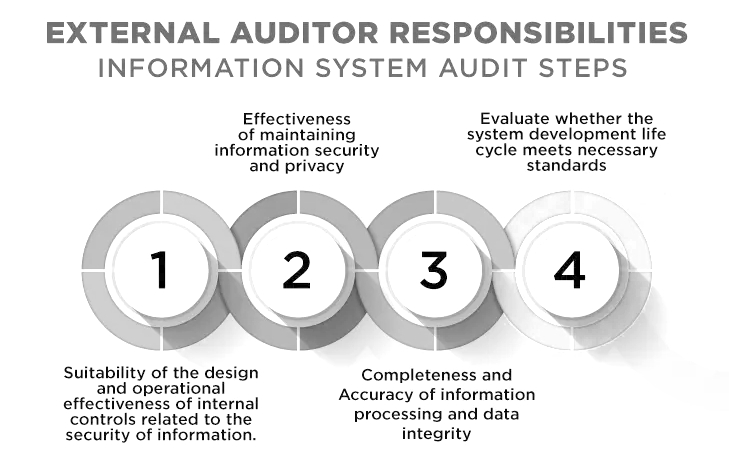

External Auditor

As an external auditor, we conduct independent audits of financial statements to ensure accuracy, transparency, and compliance with accounting standards and regulations. Our external audit reports provide stakeholders, investors, and regulatory authorities with confidence in your financial performance and integrity.

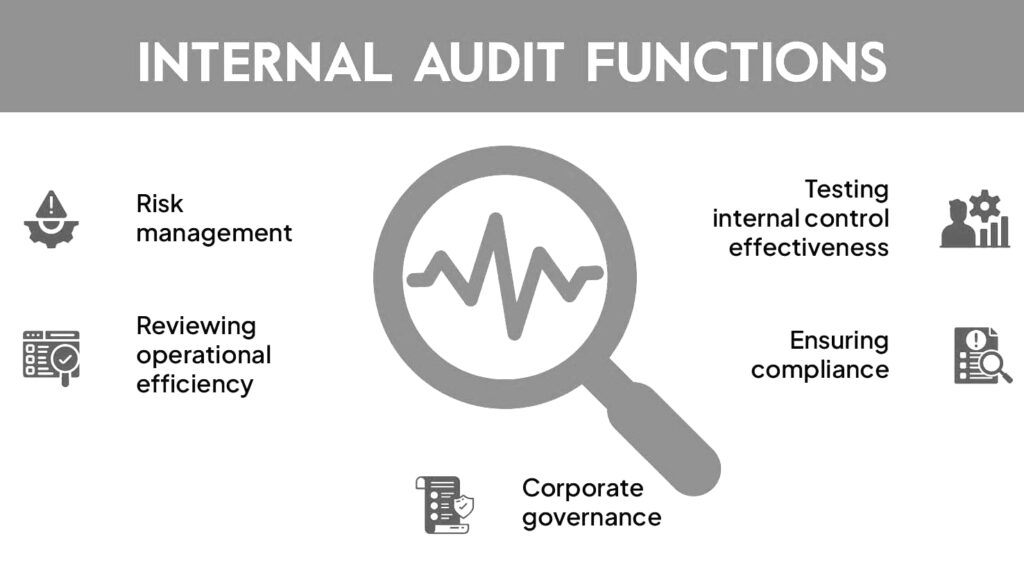

Internal Auditor

Our internal auditing services focus on evaluating internal controls, risk management processes, and operational efficiency within your organization. We identify areas for improvement, strengthen internal controls, and ensure compliance with company policies and procedures. Our internal auditors play a crucial role in enhancing organizational performance and governance.

Tax Auditor

One Audit’s tax auditing services help businesses navigate complex tax environments and ensure compliance with tax laws and regulations. We review tax returns, financial records, and transactions to assess tax liabilities, identify potential risks or discrepancies, and provide strategic tax planning guidance.

Forensic Auditor

Our forensic auditing expertise includes investigating financial fraud, misconduct, and irregularities. We use forensic accounting techniques to uncover evidence of fraud, embezzlement, asset misappropriation, and financial misstatements. Our forensic auditors play a critical role in detecting and preventing fraud, conducting internal investigations, and supporting legal proceedings.

FAQ

What is an external audit, and why is it important for my business?

An external audit is an independent examination of a company’s financial statements by an external auditor. It is crucial for providing assurance to stakeholders, investors, and regulatory authorities regarding the accuracy and reliability of financial information.

What does an internal auditor do, and how can it benefit my organization?

Internal auditors evaluate internal controls, risk management processes, and operational efficiency within an organization. Their role is to identify areas for improvement, strengthen internal controls, and ensure compliance with company policies, benefiting the organization by enhancing performance and governance.

When should I consider hiring a tax auditor?

You should consider hiring a tax auditor if you want to ensure compliance with tax laws and regulations, assess tax liabilities accurately, identify potential tax risks or discrepancies, and receive strategic tax planning guidance.

How does forensic auditing differ from other types of audits, and when is it necessary?

Forensic auditing focuses on investigating financial fraud, misconduct, and irregularities using forensic accounting techniques. It differs from other audits in that it involves detailed examinations to uncover evidence of fraud or financial misstatements. It is necessary when there are suspicions of fraud, embezzlement, or other financial misconduct.

What are the benefits of conducting regular audits for my business?

Regular audits help in ensuring accuracy, transparency, and integrity in financial and operational processes. They provide valuable insights, identify risks, prevent fraud, enhance compliance, and improve overall business performance.

How can auditing help in identifying and mitigating financial risks within my organization?

Auditing helps in identifying financial risks by evaluating internal controls, assessing risk management processes, and conducting thorough examinations of financial records. It enables organizations to proactively mitigate risks and strengthen internal controls to safeguard against potential financial threats.

What should I expect during an audit process, and how long does it typically take?

During an audit process, you can expect auditors to review financial statements, internal controls, documents, and procedures. The duration of an audit varies depending on the size and complexity of the organization but typically ranges from a few weeks to several months.

How can I choose the right auditor or auditing firm for my business needs?

When choosing an auditor or auditing firm, consider factors such as their experience, expertise, reputation, industry knowledge, compliance with auditing standards, and compatibility with your business’s values and objectives. Conducting thorough research, checking references, and interviewing potential auditors can help in making an informed decision.

Unveiling Efficiency Gains Through a Business Process Audit

Schedule a Free Consultation to Discuss Your Audit Needs and Protect Your Business from Financial Crime.

Request a Now.